Storage – The storage aspect of TPS pertains to the placement of an organization’s input and output digital data or documents.The original invoice can then be marked as “paid” in the company’s TPS. If a supplier submits an invoice to you, you can send the seller a payment confirmation once you have paid the invoice. In addition, they can be an important source of data for government-related reasons, such as tax.

This may consist of receipts for record-keeping to verify a transaction or sale.

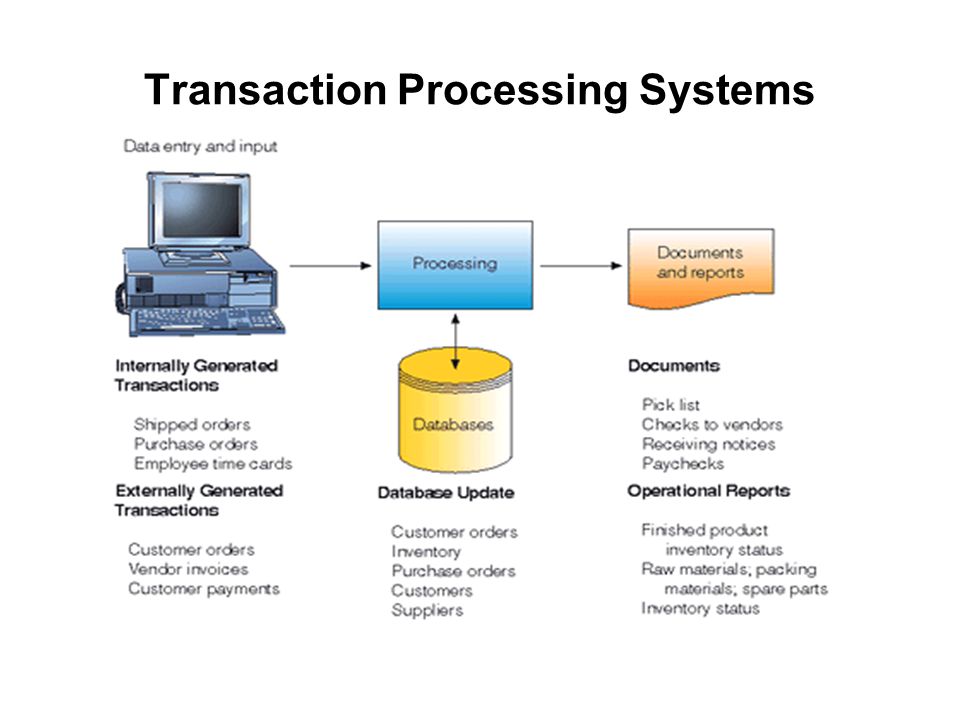

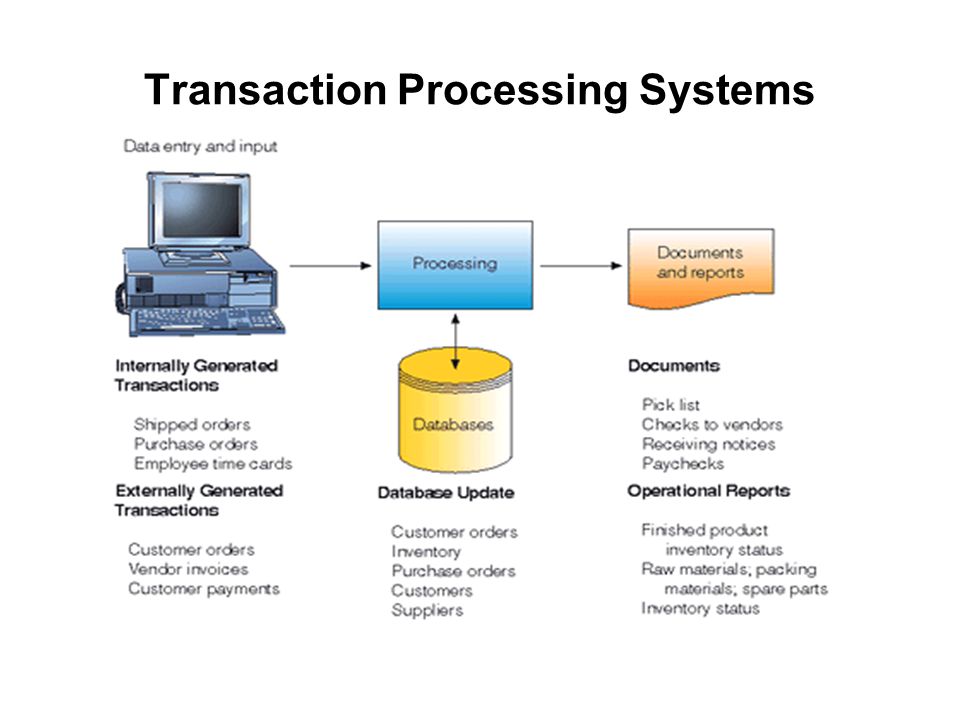

Output – Once the system has processed all the inputs, the system will generate the output documents. Typical inputs include Bills, Coupons, Invoices, and Custom Orders

If your company uses a real-time Transaction Processing System, each input is managed in real-time. Consequently, if your company uses batch processing, your Transaction Processing System will store and handle batches of inputs. Input – A request for a product or a payment payable to an organization’s transaction processing system by a third party constitutes an input.

The processing is the component responsible for breaking down the data contained within the inputs, transforming it into formats that computers can decipher. An example of this would be patron order slips or invoices. The input is usually source documents obtained from the transactions that function as inputs for accounting systems. The output refers to the reports or records that the TPS generates. TPS comprises four components: outputs, inputs, storage device, and the processing system. Most transactions will therefore be of short duration, while the activity for every transaction will be programmed well in advance. Instead of allowing users to operate arbitrary time sharing programs, TPS only allows structured and predefined transactions. It will also try to offer predictable response times for predictable requests, especially for processing in real-time. TPS is an information system that will store, collect, retrieve and alter data transactions for an organization. Customers can view real-time credit card transactions, although the data are updated in batches. The bank receives all impressions collectively.

An impression of the credit card is made on a credit slip, which a sales clerk subsequently fills up. The bank receives and processes all impressions in a single batch. Credit Card Transactions (Manual) – A credit card impression is imprinted on a credit slip, which is then filled up by a sales clerk. After a check is cleared, money is withdrawn. It is necessary to establish if the individual has sufficient financial resources (which takes three days). They are placed into individuals’ bank accounts. Cheque Clearance – A written instruction to a bank directing that funds be transferred to a designated account. Similar to reservations systems (which maintain product, availability, usage, and maintenance information).īatch Transaction Processing System Examples The library’s lending system – Used to maintain track of borrowed things, which may be identified by the user’s card and the barcodes on the products. For example, after inputting the product number into a POS terminal, the right product pricing is returned. Point-of-sale (or POS) terminals – Used by retail enterprises to sell products and services, POS terminals lower the cost of bulk data processing by transforming data to a format that can be easily transmitted over a communication system. In such a case, the goods or service is kept until a fair response time. Reservation systems – Reservation systems are beneficial in any sector where a product or service is reserved for a specific consumer (e.g. RELATED: Online Payment Options for Small & Medium Businessesīelow, are some examples to help you understand the concept: Real-Time Transaction Processing System Examples Thus, an online transaction processing system is the e-commerce system’s counterpart for an online store. Additionally, it integrates with the business’s point of sale system, or POS, which processes credit cards, produces receipts and receives and holds cash. The transaction processing system (TPS) further secures the success of each transaction by storing, transferring, and receiving data via a database. Rather than enabling users to run any application concurrently, transaction processing allows only specified, ordered transactions. Additionally, transaction processing systems strive for predictable response times to queries, while this is less crucial in transaction processing systems than in real-time systems. What is a Transaction Processing System (TPS)?Ī Transaction Processing System (TPS) is a kind of information system used to gather, store, modify, and retrieve data transactions for an organization. What is a Transaction Processing System (TPS)?.

0 kommentar(er)

0 kommentar(er)